Prime Minister Youth Loan Scheme Registration 2025

Dear youngers! Remember one thing you are the future of Pakistan. All Almighty Has blessed you with many skills and qualities. Use your Skills in Good ways and become the reason for the development of Pakistan. You are the builder of the nation. To Develop Your Skills, the Prime Minister of Pakistan Has started the Youth Loan program.

Leading youth affairs is excellent work as the ability to work for the welfare of 68% of the population. Our Priority is to make Facilities in every field for youth. We are trying to change your bright future through the PM Laptop Scheme, the Loan Scheme, the Youth Development Center, and the National Youth Commission. Join us and make Pakistan successful and happy.

Prime Minister Youth Loan Scheme

The youth program was started in 2013-2018 by the Pakistani Government. This Program has many schemes. The Prime Minister’s Interest-Free Loan Scheme, the Prime Minister’s Youth Business Loan Scheme, the Prime Minister’s Youth Training Scheme, the Prime Minister’s Youth Skills Development Scheme, the Prime Minister’s Scheme for the Provision of Laptops, and the Prime Minister’s Scheme for the Reimbursement of Fees of Students from the Less Developed Areas.

Maryam Nawaz Sharif led the charge. Twenty billion Pakistani rupees were to be invested over a period of five years. The government announced interest-free loans of up to Rs. 50,000 on May 14, 2014, and 10,000 people across the country will benefit from them, and as many women as men will receive aid.

You can also apply: PM Laptop Scheme.

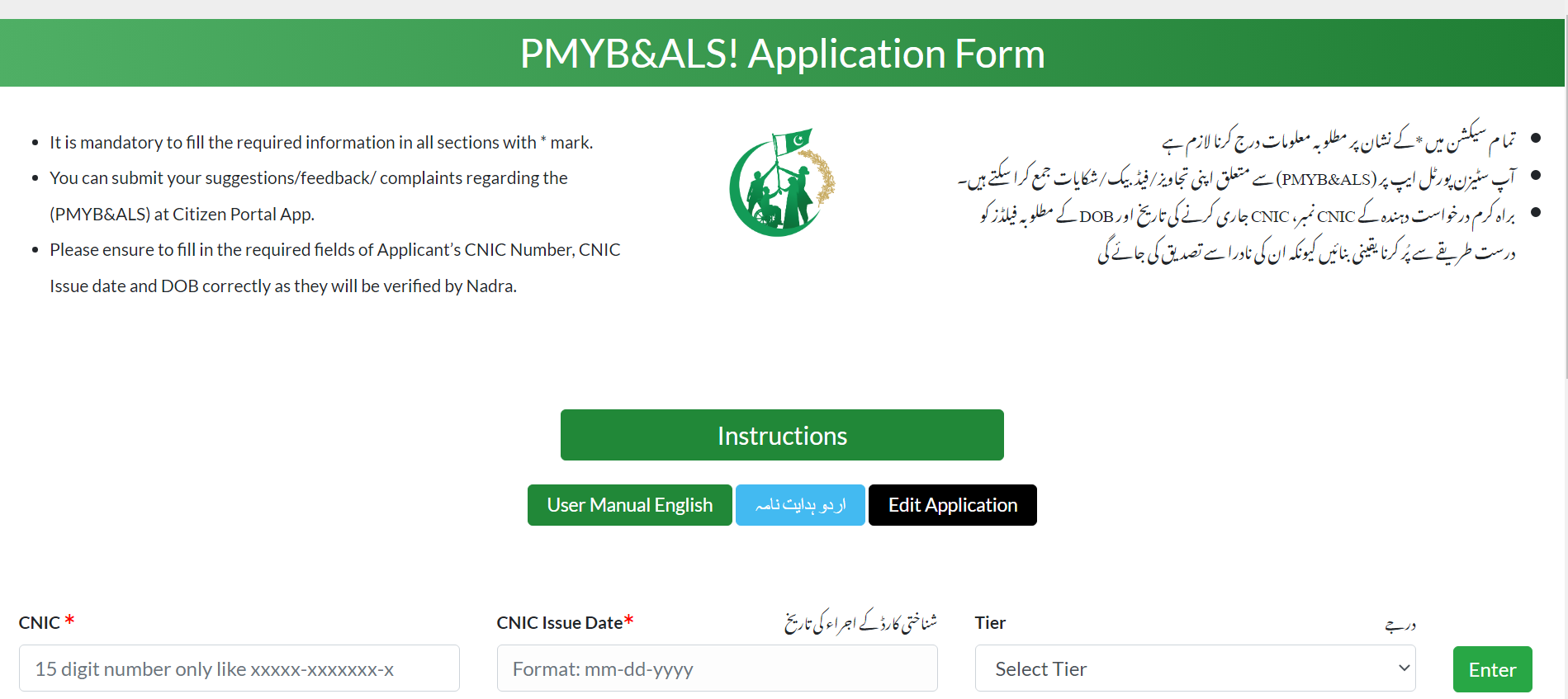

Youth Loan Program Application Form

You can apply for the Youth loan program in 2025. Here, we will give all the details about applying for a loan in a simple way. Please Fill out this form to apply for the Youth Loan Program 2025.

How to apply for pm youth loan new update

- Documents required:

- Passport size picture CNIC (front and back side)

- Latest Educational degree/certificate (if applicable)

- Experience certificate(s) (if applicable)

- License/Registration with Chamber or Trade Body (if applicable)

- Recommendation Letter from respective chamber/trade body or Union (if applicable)

- Information required: National Tax Number Consumer ID of electricity bill of your current address Consumer ID of electricity bill of your current office address (if applicable)

- Complete the registration number of any vehicle registered in your name (if applicable). Name, CNIC, and mobile numbers of two references other than blood relatives. Estimate of monthly business income, business expenses, household expenses, and other income (for new business). Actual monthly business income, business expenses, household expenses, and other income (for existing business)

Other Requirements:

- Sign up to submit an application

- Mobile number registered in your name

- At least 15 minutes to complete the application form

- Option to save a draft for submission later

- Upload as much information as you have (e.g. Financial Statements, Business Feasibility, Last 6 months Bank statements)

- The application registration number will appear on the screen, and you will receive an SMS once the form is submitted.

- SMS once your application moves to the next stage of the process

- Check the application status on the official website.

Prime Minister Youth Loan Scheme 2025

This program was started in 2019 and still continue in 2021. The Youth of Pakistan would apply for this loan. This loan was to help students in their studies and develop their businesses. The loan was free of interest. And youth can pay this in smart installments. Many people in 2021 applied for this loan and took advantage of it. This was a good act of government in covid19.

PM Youth Business Loan 2025 Loan Size

Applicants can apply for a loan amount of Rs.7-5 million under the PM Youth Business and Agriculture Loan Scheme. If he does not understand how to apply. So he can get all his information by visiting the PM Youth business site After visiting the website, you have to click on the registration button and all the registration steps will be explained to you.

Eligibility Criteria Youth Loan

Loan program (PMYB&ALS)

- Any Pakistani, including (AJK & GB) National, having CNIC or Form B with Age 18-45

National Innovation Award

- Any Pakistani, including (AJK & GB) National having CNIC or Form B with Age 15-35

Talent Hunt Youth Sports League (THYSL)

- Any Pakistani, including (AJK & GB) National having CNIC or Form B with Age: 15-25

Conclusion:

This article has been written for those people who want to get a loan from the Ehsaas program and Want to start their own business. This is a good option For middle-class families. I hope after reading this, You have No problem or confession. If you have any problem with getting a loan, you can contact customer support and Get a Solution for your problem. You can also check this

You Can Also Read Prime Minister’s Youth Business & Agriculture Loan Scheme

Loan Repayment Terms

Prime Minister Youth Living Online Apply offers borrowers flexible repayment terms. The loan tenure can range from three to eight years depending on the loan amount and the nature of the business.

The loan requires monthly or monthly installments and the interest rate is fixed throughout the repayment period. If you follow these steps, you will get the loan. If you do any of these steps, you won’t get a loan at all

You Can Also Read More: Prime Minister Youth Development Program New Courses

FAQS

What is the Prime Minister Youth Loan Scheme?

The Prime Minister Youth Loan Scheme provides financial support to youth through interest-free loans to start or expand businesses and improve their skills.

What was the purpose of launching this program?

The purpose is to empower the youth economically and help them contribute to Pakistan’s development through entrepreneurship and skill-building.

What are the eligibility criteria for this scheme?

Pakistani nationals aged 18-45 years with valid CNIC or Form B are eligible, including residents of Pakistan.

How can one apply for the Youth Loan Scheme?

Applicants can register online on the official website by submitting necessary documents such as CNIC, passport-size photo, and business details.

What are the repayment terms for the loan?

The loan repayment period ranges from 3 to 8 years with flexible monthly installments and a fixed interest rate.